Thank You, 2025! Hello, 2026: The Year AI Stops Hyping and Starts Delivering

2026 AI trends: AI Valuation Crash, autonomous agents, smaller models, ecosystem consolidation. What skills to learn. Why the local opportunity beats chasing tech jobs.

This year wasn’t just about discovering new platforms or tools. It was about the chaos around them — the highs, the nonstop action, the drama, acquisitions, failed acquisitions, and models that either surprised everyone or completely missed the mark like ChatGPT-5 or like Google Gemini coming back into the game.

So much happened in such a short time. And before jumping into what’s next, I want to pause and reflect on how dramatically this entire space has transformed over the year.

No Time to Read? Here’s the Scoop

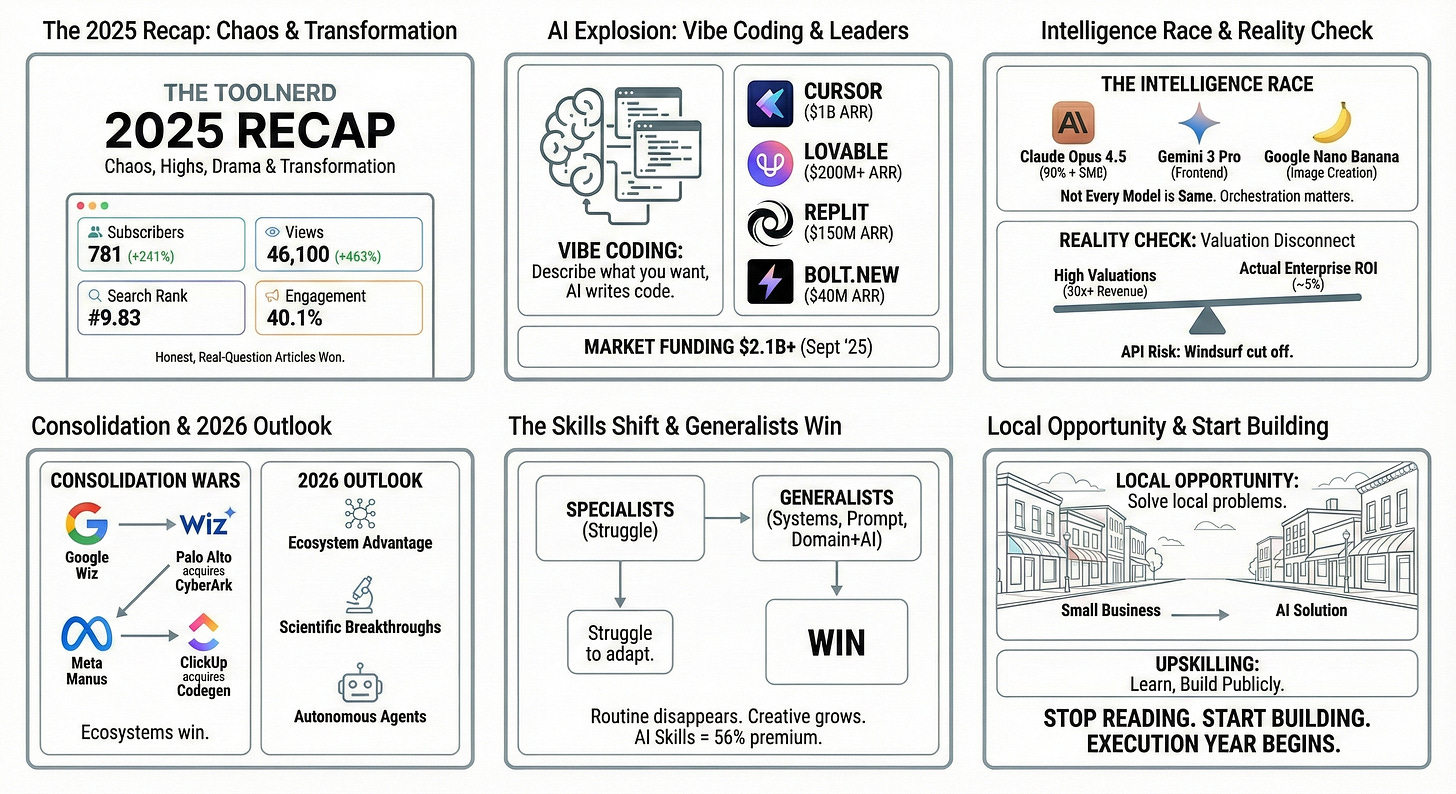

The 2025 Recap of The ToolNerd

To our readers: thank you.

The numbers tell a story worth celebrating.

In 2025, The ToolNerd grew from 229 to 781 subscribers—a 241% increase. But the traffic growth was even more dramatic: 46,100 views, up 463% from the previous year. That’s not a modest climb. That’s a transformation.

What excites me more than the metrics is why they grew. It wasn’t because we published more. We published 56 articles—a steady, manageable pace. It wasn’t because we chased every trending topic. It was because we got honest about what actually matters.

The articles that won were never the ones hyping the latest startup. They were the ones answering real questions:

“I Tested Claude Code for a Week” (1,604 views) — Real testing, real feedback.

“Best Tools to Build AI Agents” (1,960 views) — Practical guidance when choices matter.

“Replit vs Bolt vs Lovable: Hands-On Review” (916 views) — Comparisons that help people decide.

“Windsurf & Codeium Feedback Guide” (1,596 views) — Deep expertise, honest critique.

Our search authority grew just as dramatically. We started 2025 at position 40.78 in search rankings and finished at position 9.83—a 31-position improvement that put us on the first page of Google for the tools space. Our clicks grew 191.7% and impressions exploded 1,554.5%.

But here’s what really struck me: while our traffic grew, our engagement stayed high. 40.1% engagement rate across 13,000+ active users means people weren’t just landing and leaving. They were reading, clicking, learning, coming back.

That’s the foundation for what we’re building in 2026. Looking forward to reaching 2000+ Subscribers.

If you are reading this and want to stay updated on the AI happenings and Tools, do subscribe.

The 2025 AI Explosion— The Vibe Coding Gold Rush, Democratisation of Intelligence, Acquisitions

If 2024 was about building models, 2025 was the year about figuring out what to build with them. And the market responded with historic levels of excitement, funding, and consolidation.

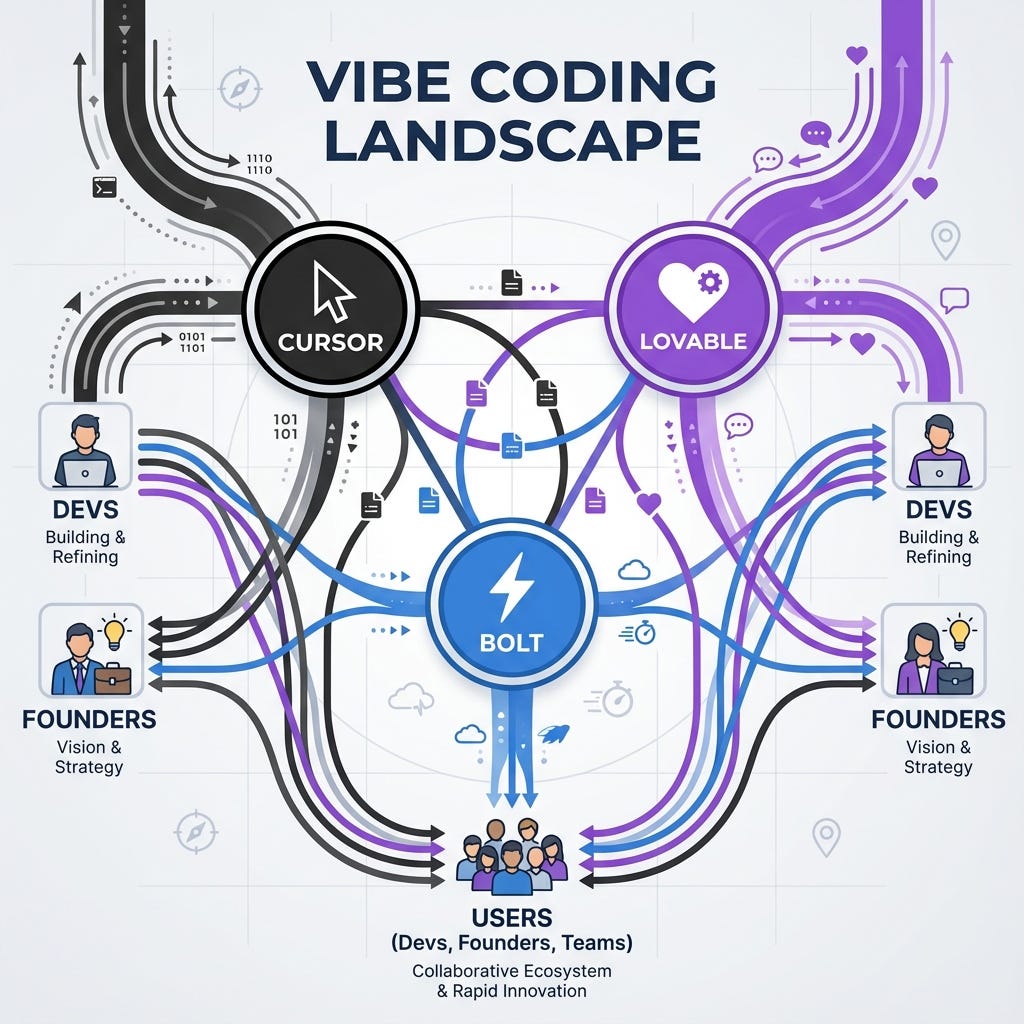

The Vibe Coding Phenomenon

“Vibe coding” became the term of the year—and the investment darling of 2025. The premise was simple: instead of writing code, just describe what you want. The market response was explosive.

The Market Leaders

Cursor (Anysphere) dominated the AI-native developer space, becoming the fastest software company in history to hit $1 billion ARR. By November 2025, they’d raised a $2.3 billion Series D, pushing their valuation to $29.3 billion. Cursor reached this milestone with $1B+ annual revenue, counting NVIDIA, Uber, Adobe, and OpenAI as customers. They’re not just a tool—they’ve become the default operating system for AI-native developers, effectively replacing VS Code for a new generation.

Lovable took a different angle: targeting non-developers and founders. Their promise? “Idea to app in hours.” They became the fastest company in history to hit $100M ARR (in just 8 months), then doubled to $200M+ ARR by November 2025. Their Series B raised $330 million at a $6.6 billion valuation. With 25+ million projects built on the platform and customers like Klarna, Uber, and Zendesk, Lovable proved something radical: non-developers can now build production applications.

Replit transformed from a struggling $2.8M ARR (end of 2024) to $150M ARR (September 2025)—a 2,400% year-over-year growth rate. They raised $250 million in Series C at a $3 billion valuation, with partnerships from Microsoft Azure and Google Cloud.

Bolt.new achieved $40M ARR in just 6 months (launched October 2024), growing from $60,000 to $500,000 in daily revenue at peak. Their Series B raised $105.5 million at a $700M valuation. Notably, Anthropic CEO Dario Amodei pointed out that Bolt’s usage temporarily maxed out Anthropic’s GPU capacity—the fastest growth they’d ever seen from any customer.

The Market Reality:

Total AI coding funding: $2.1B+ through September 2025 (already exceeded all of 2024)

92% of US developers now use AI coding tools daily

41% of all code written is now AI-generated (GitHub data)

Over 50% of Fortune 500 companies actively using these platforms

The AI coding tools market: $7.37 billion in 2025, projected to reach $23.97 billion by 2030 (26.6% CAGR)

The Intelligence Race - Not Every Model is Same

While vibe coding captured headlines, the underlying model intelligence also reached critical mass. Claude Opus 4.5 was the first model to hit 80%+ on SWE benchmark and this has changed the game. Gemini 3 Pro has cracked the Frontend Design and Google Nano Banana has changed the Image Creation.

Every model has their own strengths and weaknesses, not every model is the same. That’s a big realisation for me.

One pattern was clear: intelligence was becoming commoditized.

This created a paradox. More intelligence didn’t mean proportionally more value. Instead, it shifted focus: what matters now is orchestration—connecting these intelligent models into workflows that actually solve problems.

The Consolidation Wars: 2025’s Most Dramatic Deals

While startups were raising record funding, Big Tech was strategically acquiring. The acquisitions of 2025 tell the story of where the real power is shifting.

The Windsurf Saga (The Year’s Most Complex Deal)

Windsurf’s journey in 2025 became the perfect metaphor for the market’s consolidation instincts.

May 2025: OpenAI agreed to acquire Windsurf for $3 billion to compete with Cursor.

July 2025: The deal collapsed. Microsoft (which owns GitHub) blocked the deal—they weren’t about to let OpenAI own a rival coding tool.

The Split: Google swooped in with a $2.4 billion “reverse acqui-hire.” They paid to license the technology and hired CEO Varun Mohan and the core R&D team for Google DeepMind. Cognition AI (makers of “Devin,” the AI engineer) then acquired the remaining assets (brand, users, product) to merge Windsurf into their own platform.

Result: Google got the talent. Cognition got the product. OpenAI got nothing. This is consolidation in action.

Read more here :

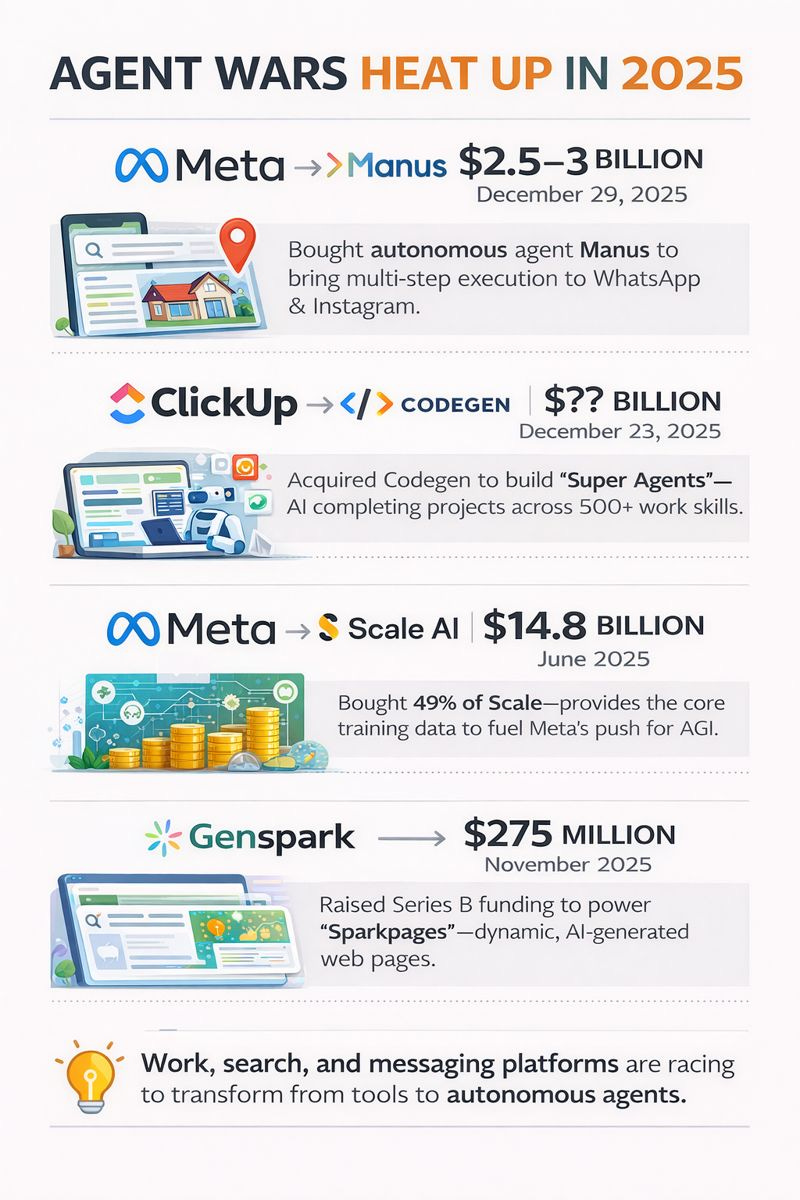

The Agent Wars

Meta acquired Manus (December 29, 2025) for an estimated $2.5-3 billion. Manus wasn’t a chatbot—it was an autonomous agent capable of multi-step execution (e.g., “Find me a house in this area, contact the broker, schedule a viewing”). Meta’s move signals their pivot: they want to move beyond chat into action, embedding agents directly into WhatsApp and Instagram.

ClickUp acquired Codegen (December 23, 2025) to accelerate their Super Agents—AI that can autonomously complete projects, generate software, and take action with 500+ work skills. Jay Hack, Codegen’s founder, became ClickUp’s Head of AI. This wasn’t just a tool acquisition. It was a statement: work management platforms are becoming AI agents. Standalone Codegen shut down January 16, 2026.

Meta made their largest AI bet: a $14.8 billion stake in Scale AI (announced June 2025). Scale AI provides the training data that fuels model development—the raw ingredient for AGI. Meta paid $14.3 billion for a 49% stake in the company, and as part of the deal, hired Scale AI’s founder Alexandr Wang to lead Meta’s new “Superintelligence” team. Wang stepping back from Scale to join Meta shows how serious this move was. Mark Zuckerberg, frustrated with Meta’s AI standing compared to OpenAI, committed to securing the infrastructure needed to compete at the highest level.

Genspark raised $275 million in Series B (November 2025) at a $1.25 billion valuation. Their innovation wasn’t just searching—it was generating “Sparkpages”: dynamic web pages built on-the-fly to answer queries.

Infrastructure Consolidation:

The biggest deals of 2025 weren’t in applications—they were in compute, data, and security. While startups fought over market share, Big Tech was buying the foundations underneath:

Google acquired Wiz for $32 billion (cloud security—largest tech acquisition of 2025)

Palo Alto acquired CyberArk for $25 billion (identity security for AI agents)

IBM acquired Confluent for $11 billion (real-time data streaming to feed AI)

Databricks acquired Neon for $1 billion (serverless Postgres for AI applications)

Nvidia acquired a 4% stake in Intel for $5 billion (September 2025, securing chip supply)

Behind the scenes, data centers became the new battlefield.

$61 billion flowed into data center acquisitions in 2025—a staggering increase. Over 100 data center transactions closed in just 11 months.

Why?

Because building AGI requires compute power. Lots of it. Meta alone committed $600 billion in U.S. infrastructure through 2028. OpenAI made deals worth $100+ billion for GPU capacity (Nvidia), $30 billion with Oracle for cloud services, and committed to a $300 billion Oracle compute deal starting in 2027.

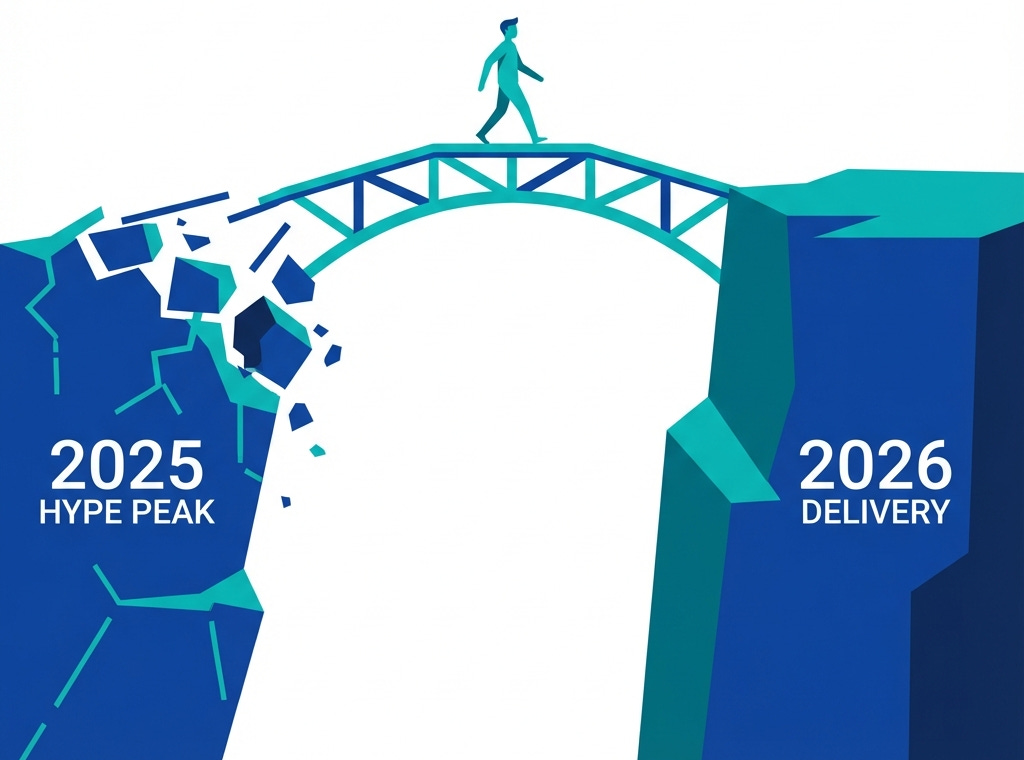

The 2026 Reality Check - AI Isn’t Overhyped, It’s Over-Funded

In 2025, it was all Hype, Explosive growth and historic funding rounds but that doesn’t mean they are sustainable businesses.

The real question isn’t “How much was raised?” It’s “How much actual value are these companies delivering compared to their valuations?”

We believe 2026 will be the year of Reality Check and more focus on delivering actual value.

The AI Valuation Disconnect

The thing nobody talks about: a lot of AI investment still isn’t turning into measurable business impact.

Research from MIT showed that ~95% of enterprise GenAI pilot programs show little-to-no measurable impact on P&L, with only ~5% delivering rapid revenue acceleration. Separately, S&P Global Market Intelligence found 42% of businesses are scrapping most AI initiatives (up from 17%), and the average org cancels 46% of AI proof-of-concepts before production. They’re experimenting. Placing bets. But the wins aren’t showing up yet.

This is the hidden story of 2025. While Cursor raised $2.3 billion and Lovable doubled to $200M+ ARR, the obvious question was: “Do these valuations actually make sense?”

Cursor trades at 30x forward revenue. Lovable at 33x ARR. These multiples are way above typical SaaS benchmarks (which run 10-15x for growth companies). The bet: category leaders will grab outsized market share of a booming market.

But what if growth slows? What if ROI takes longer? What if productivity gains plateau faster than we think?

That’s the volatility underneath.

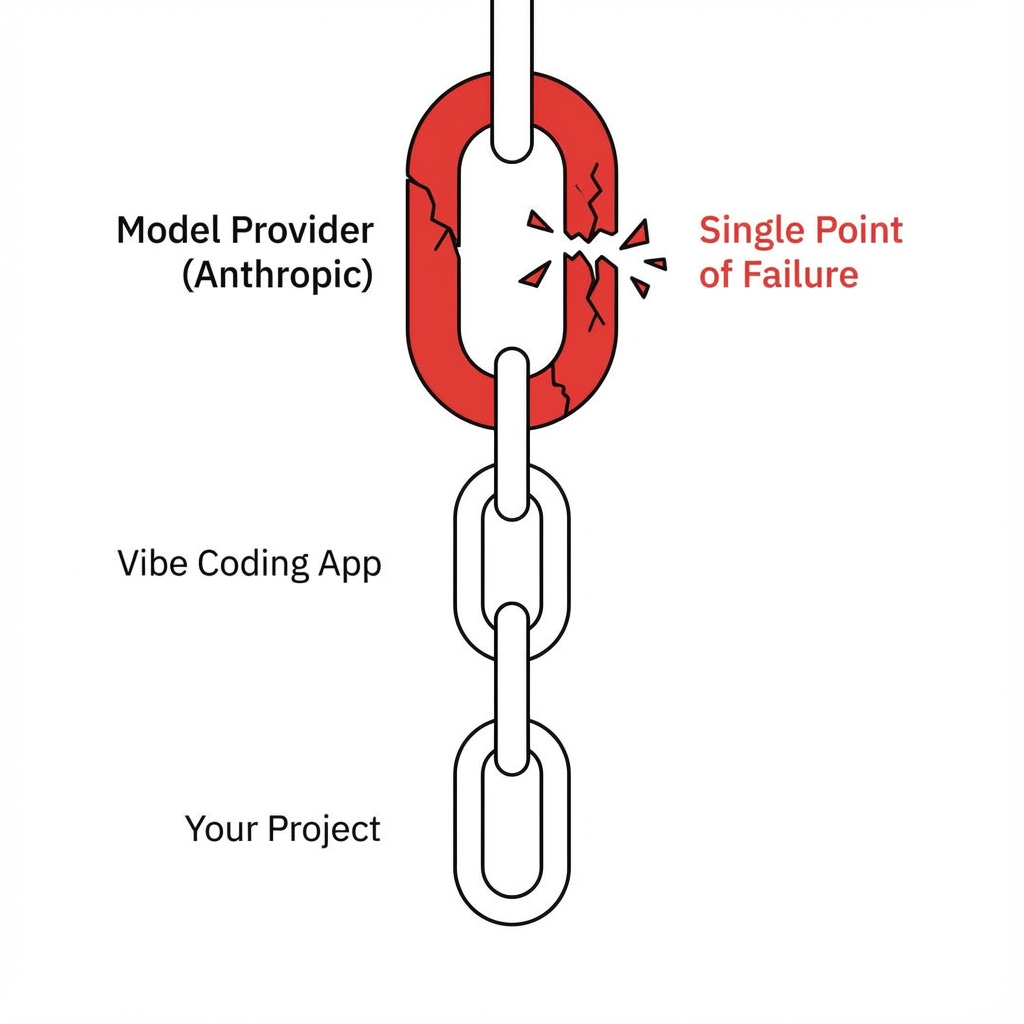

The API Dependency Risk

The darker reality: in May 2025, Anthropic cut off Windsurf’s access to Claude models (3.5 and 3.7 Sonnet). Their reason: Anthropic found out OpenAI was acquiring Windsurf for $3 billion and worried the platform might use Claude outputs to train competing models.

Think about that. Windsurf—valued at $3 billion—nearly collapsed overnight when a model provider flipped a switch.

It’s not a one-off thing. The entire vibe coding ecosystem sits on top of dependencies it doesn’t control.

The takeaway:

If the API shuts down, your product dies—unless you’ve built backup plans.

Model providers control the leverage. No loyalty. Just market dynamics.

Power imbalance is structural. Anthropic, Google, OpenAI, Meta built the models. Everyone else is a tenant.

This will shape 2026: every vibe coding platform needs its own stack, multiple model sources, or faces the risk like that of Windsurf

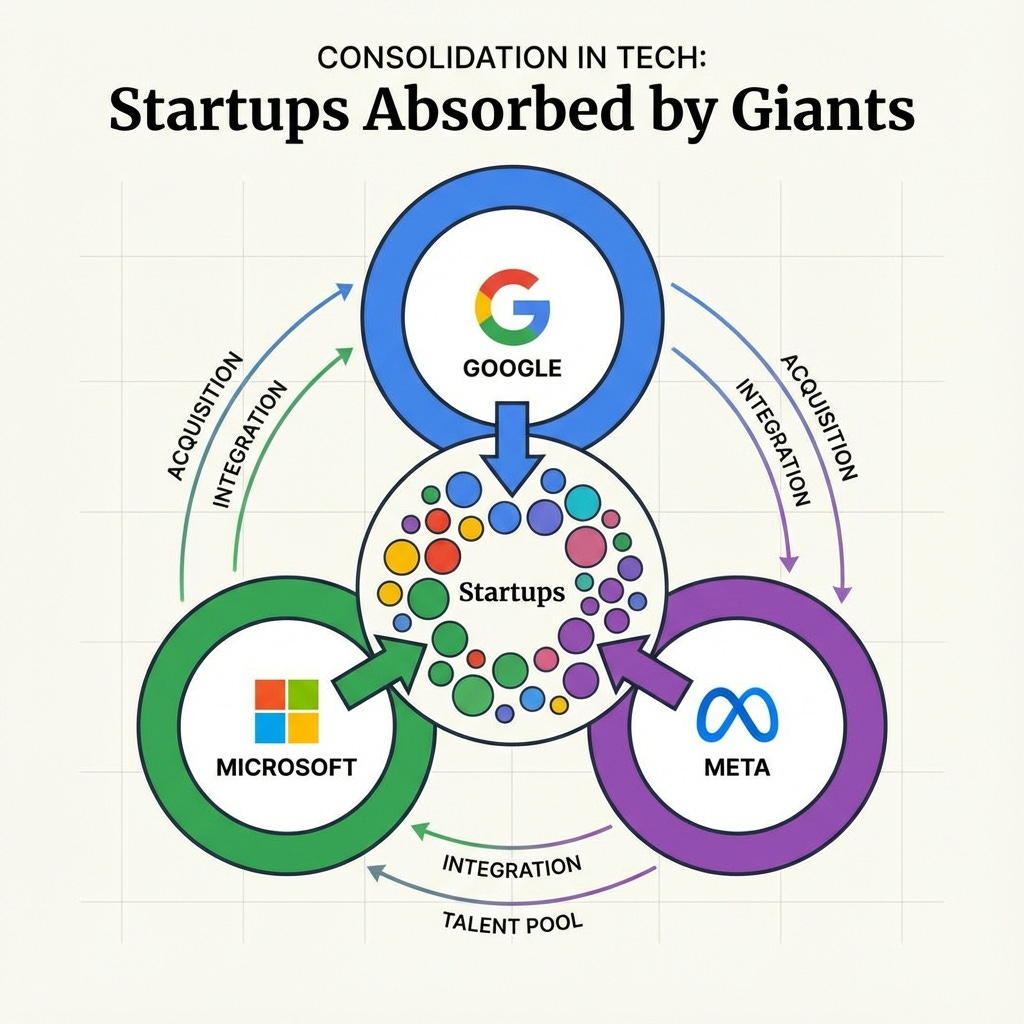

Consolidation Gets Real

2025 made the pattern obvious: Big Tech acquires teams and assets. Smaller players disappear.

2026 will accelerate this trend:

3-4 big players will dominate. CB Insights says the top 3 (GitHub Copilot, Cursor, Claude Code) already own 70%+ market share. That gap widens.

Defensibility matters more than users. Proprietary data, models, and deep integrations are mandatory.

Acqui-hires become the norm. Startups get bought for their teams, not their products.

Most heavily funded startups won’t IPO. They’ll be acquired at lower valuations - - or quietly disappear.

What Survives the AI Hype Cycle - Will Go a Long Way

None of this means AI fails or becomes a bubble. AI is real and here to stay.

What’s at risk are the business models assuming:

Growth rates keep accelerating

Model access stays cheap and available

Startups compete with Big Tech’s scale

Valuations reflect long-term value, not hype

2026 tests those assumptions.

Companies building for actual ROI, diversifying model sources, creating defensible moats - they’ll win. Everything else faces pressure.

Not doom. Just how markets work. Hype peaks in 2025. Reality hits in 2026.

But here’s what actually matters: understanding this landscape gives you an advantage. The question shifts from “Which startup should I join?” to “What should I actually get good at?” And that’s where things get interesting.

What to Look For in 2026

After the reality checks, here’s what’s actually worth paying attention to in 2026. Multiple innovation paths are opening up—not just one winner.

The Ecosystem Advantage - Why Integration Beats Innovation

The 2025 hype missed something obvious: individual tools don’t win. Ecosystems do.

Cursor and Lovable are genuinely impressive. But they solve one problem. Organizations don’t buy single tools—they buy suites. In 2026, companies bundling intelligence across entire workflows beat those optimizing for one use case.

Google’s move: Gemini 3 everywhere—Gmail, Docs, Sheets, Slides, YouTube, Cloud. One subscription covering coding (Antigravity), design (Nano Banana), video (VIDS), research (Notebook LM). One contract. One interface. One model family across your whole workflow.

Microsoft’s approach: Copilot built into what people already use—Office, Windows, Azure, Teams, GitHub. No switching costs. AI’s already embedded in the tools.

OpenAI’s angle: Building the engine other platforms use—ChatGPT Enterprise, GPTs, Canvas, API access. Not embedding everywhere. Enabling others to embed them.

In 2025, teams pick tools one at a time. Cursor here, Lovable there, v0 somewhere else. In 2026, CIOs enter the room. The question shifts from “Which tool is best?” to “Which suite gives us the best ROI?”

The simple fact: In 2026, “we have better models” loses to “we’re integrated everywhere.” A 5%-worse model baked into your email, docs, and code beats the best model requiring new integrations. By mid-2026, most enterprises pick one main ecosystem (likely Google or Microsoft) and add niche tools where needed. Not about tool quality. About operational efficiency.

Scientific Breakthroughs Are Coming

Sam Altman says he’s “most excited about” using AI and compute power to uncover new science. He predicts 2026 brings systems that solve genuinely new problems—the kind of breakthroughs that needed human genius.

Dario Amodei (Anthropic) goes even further: major medical breakthroughs every 10 years instead of 100. Think CRISPR or mRNA vaccines, but delivered constantly. Prevent most infections. Treat cancers. Cure genetic diseases. Not science fiction. Logical extension of what happens when top researchers have AI thinking alongside them.

AI That Knows You

Altman’s next bet: AI remembering “every detail of your entire life” by 2026. Not just ChatGPT knowing you. Every app. Gmail knows your inbox context. Docs knows your voice. Code editors know your codebase.

People who crack this get a huge advantage. People using these systems won’t want to switch.

Autonomous Agents That Execute

Andrew Karpathy says 2026 is when reasoning models plus verification plus autonomous workflows become real. Not chatbots that sound smart. AI that works through problems, checks its own logic, runs full workflows alone.

Karpathy sees the profession shifting—but he’s visibly optimistic. Developers who use these tools properly become “10X more capable.”

The Decentralized Alternative - Smaller Models

While Big Tech races to build bigger, better models , we think in 2026: smaller language models will start gaining momentum. A model running on your laptop that solves 85% of your problem beats a $10 API call solving 95%—if control and resilience matter.

Watch for in 2026:

Models running locally without cloud dependence

Specialized models built for specific industries (law, accounting, healthcare)

Open-source options getting real enterprise traction

The Skills Shift - Generalists Will Win

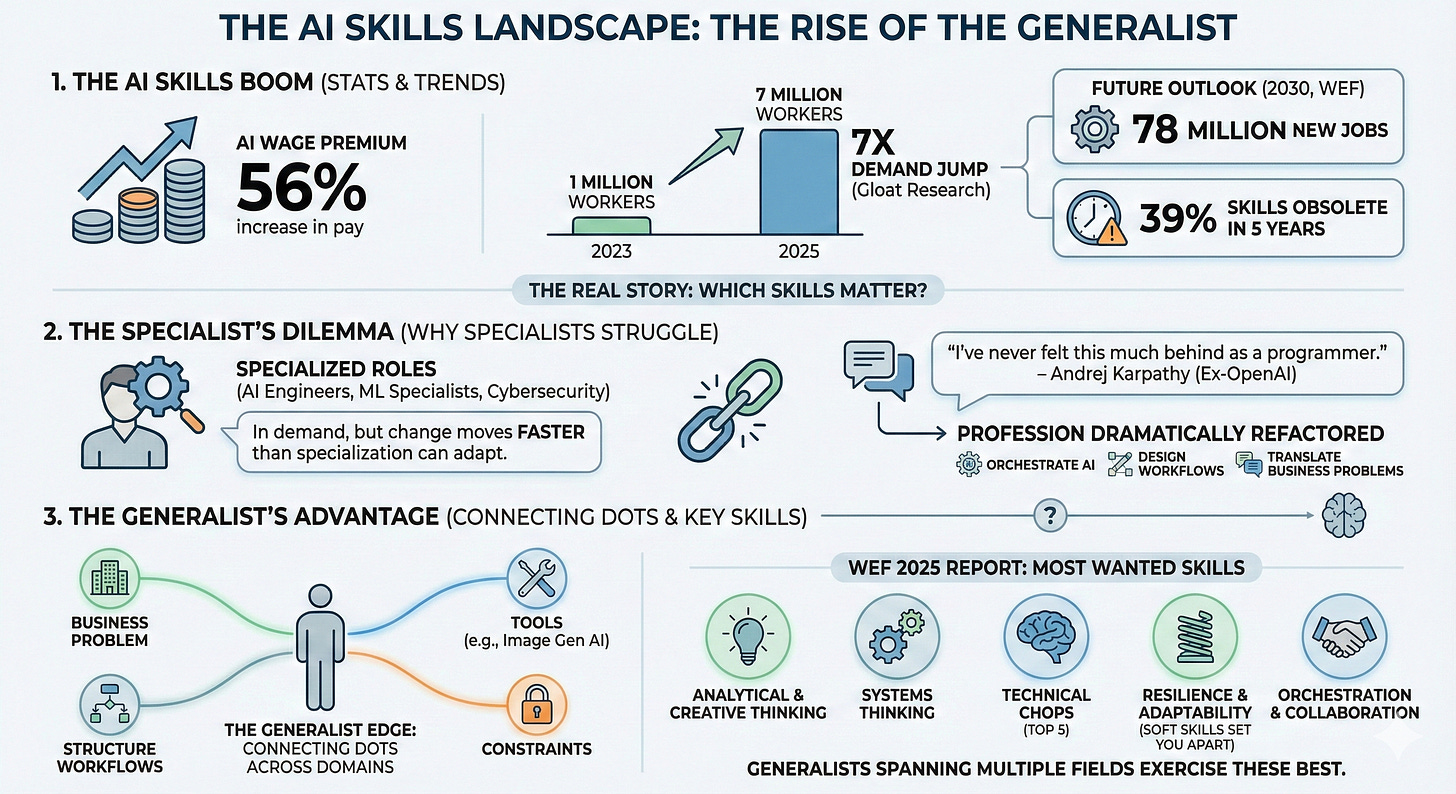

AI skills come with a 56% wage premium. Demand for AI fluency has jumped sevenfold—from 1 million workers in 2023 to 7 million in 2025 (Gloat research). The World Economic Forum expects 78 million new jobs by 2030, but also warns 39% of workers’ current skills will be obsolete in 5 years. Yet the real story isn’t the numbers. It’s which skills actually matter.

Why Specialists Struggle

Specialized roles (AI engineers, ML specialists, cybersecurity) are in demand. But the advantage goes to generalists. In an AI-driven world, change moves faster than specialization can adapt.

Andrej Karpathy, ex-OpenAI researcher, put it plainly: “I’ve never felt this much behind as a programmer.” His point: the profession is being “dramatically refactored.” Developers who succeed in 2026 aren’t the ones writing perfect code—they’re those who orchestrate AI, design workflows, and translate business problems into solutions.

The Generalist Edge: Connecting Dots

People getting hired and promoted connect ideas across domains. A jewelry store needs design iteration. They don’t need a design specialist. They need someone who understands the business problem, knows what tools exist (image generation AI), can structure workflows, and knows the constraints. That’s a generalist with systems thinking.

The World Economic Forum’s 2025 jobs report confirms: the most wanted skills are analytical thinking and creative thinking. Technical chops rank in top 5, but soft skills—creativity, resilience, adaptability—are what set you apart. Generalists spanning multiple fields exercise these best.

The Three Skills That Matter

1. Prompt & Workflow Engineering - Write clear instructions. Chain multiple AI systems together.

2. Systems Thinking - Design how AI and humans work together. Understand data flows, failure points.

3. Domain Knowledge + AI - Deep expertise in your field, then layer AI on top. That combination wins.The Market Picture

World Economic Forum data shows the splits:

Growing: Big Data work, AI Engineers, AI Governance roles (new), AI Workflow Leads, Cybersecurity

Declining: Clerical work, data entry, bank tellers, customer service reps

The shift: Routine work disappears. Judgment and creative work grow. You don’t start from scratch—clerical workers move to data analytics; customer service becomes AI orchestration.

What to Actually Learn

Essential:

Prompt engineering & context design

Workflow design

Basic data intuition

Systems thinking

Build over time:

Domain expertise

Communication skills

Creative thinking

Skip:

Code writing (AI does this better)

Specific frameworks (they shift every 6 months)

Advanced math

The Job Market & Local Opportunity

Chasing a software job in 2026 might be wrong. Not because jobs disappear. Because a bigger opportunity sits in your hometown.

Why the City Trap Doesn’t Work Anymore

Old script: Move to a hub, land a tech job, climb. Doesn’t work in 2026.

Too much competition. Millions chasing same roles.

AI commoditizes skill. Good engineers are now just people with better tools. Everyone has them.

Salary caps. You trade time for someone else’s upside.

Meanwhile, local problems sit unsolved. No one with AI knowledge is looking.

The Real Opportunity

Accounting business in a small town. Owner handles cash flow, invoices, reconciliation by hand. Cost to hire bookkeeper: $25-40K/year.

With AI, you build: voice assistant, auto invoice processing, live dashboards. Owner saves $25K/year. Build it, deploy it, take a cut of the savings.

Same pattern works for: jewelry design (AI generates instant designs), farm optimization (yield predictions), any local business with manual work.

Why Now

AI tools aren’t elite. No PhD needed. Learnable in weeks.

Barriers collapsed. Build solutions in days, not months. No fundraising.

Math works. Software engineer: $50-100K. Solving $25K problems for 50 local businesses: $1.25M/year.

Who This Fits

Know your community’s pain

Have a family business to leverage

Tired of city life

The New Story

Old: “Leave to succeed.” New: “Stay and build bigger.”

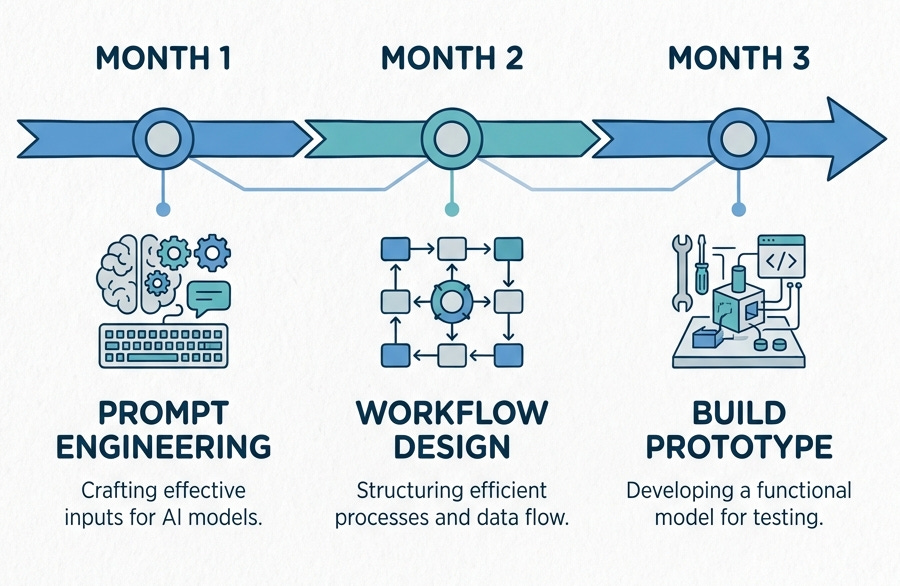

Upskilling Roadmap - Your 2026 Learning Path

You don’t need months of study. A few weeks of focus plus months of building.

We’ve put together learning paths for different directions:

Starting out: Read AI Learning Roadmap for Beginners — Part 1: Learn, Prompt, Test. Covers ChatGPT vs Claude vs Gemini, actual prompt work, weekly projects. No coding needed.

Want to create: Follow AI Learning Roadmap for Beginners — Part 3: The Creator’s Guide to Making Content with AI.

Build publicly. Share your learning. Show what you’re building. Write about the problems.

Does three things:

Keeps you accountable. Harder to quit if people watch.

Forces you to learn. Teaching reveals what you don’t know.

Gets you customers. Network becomes early adopters.

4 weeks learning. Months building. By mid-2026, you’ll have what took people years before.

What Actually Determines 2026

2026 goes to whoever has the clearest vision of what they’re solving and the discipline to actually ship.

The tech is here. Tools exist. Opportunity is massive. Only missing piece: you actually building.

So: Stop reading about AI. Start building with it.

Hype year is done. Execution year begins now.